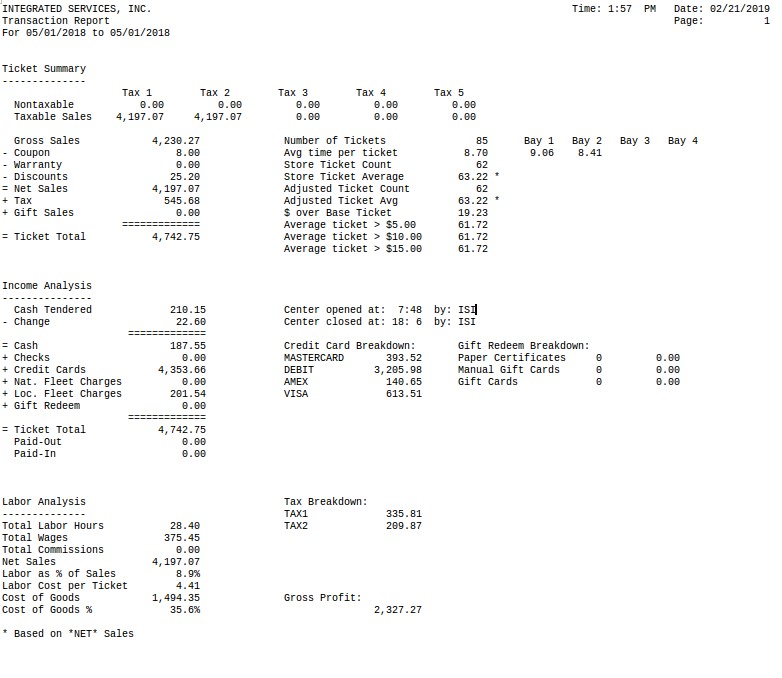

The summary version of the Transaction Report is divided into three sections: Ticket Summary, Income Analysis, and Labor Analysis. This report helps you evaluate store productivity through calculations such as the average time of service, average labor cost per car, and the average ticket amount. It is included automatically when you print the detailed Transaction Report. (See the article Transaction Report – Detailed for more information.)

The first section of the summary report corresponds with information on the detailed Transaction Report. While the detailed report lists each transaction, this report calculates overall figures, including the following:

In addition, this section analyzes the average time and average income for each ticket. Results include the following figures:

The second section, the Income Analysis section, breaks down the store’s income into the various methods of payment. It shows the total paid-in and paid-out amounts and a breakdown of credit card receipts by credit card type. These figures all concern the money received and disbursed through the till. For a single day, you can see when the center was opened and closed and by whom.

The third part of this report is the Labor Analysis section. This section helps you analyze your labor costs by calculating the following items:

This section also includes a tax breakdown that relates to the tax information in the ticket summary. Each tax is applied to the Taxable Sales amount shown at the top of the page. The amount collected for each tax type is shown in this section, and the overall total is found on the Tax line above.

On this report, several key fields provide direct measures of productivity. Three of these are the average time per vehicle, the average ticket amount and the average labor cost per vehicle. These numbers help you determine whether you are making enough profit per vehicle on average.

Use the following steps to print a summary Transaction Report:

| Field | Definition | ||

|---|---|---|---|

| Range of Dates | Fill in the beginning and ending dates you want to include on your report. Leave blank to print the report for the current date. | ||

| Print Time on Report | Printing the time helps you identify the most current report when the same report is printed more than once during a day. This field defaults to Y to print the time on the report. If you do not want the time to print on a report, type N. We recommend that you always print the time on a report. | ||

| Summary Only | This field appears for reports with both detailed and summary versions. Enter Y to print the summary report. We recommend printing a summary report under normal conditions. | ||

| Duplex | This field appears for terminals that have report type 2 enabled in the Set Up Printer Controls screen. Duplex mode enables printing on both sides of the paper.

|

||

| Landscape | This field appears for terminals that have report type 2 enabled in the Set Up Printer Controls screen. It prints horizontally on the paper. | ||

| Number of Printed Lines per Page | This value tells the computer how many lines to print on each page of the report. A typical 11-inch page can contain up to 66 lines, but this field defaults to 60 to allow three-line margins at the top and bottom of the page.

|

||

| Total Number of Lines per Page | This field indicates the length of the paper in the printer. A typical 11-inch page contains 66 lines. Your system interprets a 0 or 66 in this field to mean that standard 11-inch paper is loaded in the printer. Because a 66 causes a form feed to take more time, accepting the default, 0, is recommended. | ||

| Print Report To | This field tells the computer where to send the report. The following list contains the different selections available for this field.

|

||

| Command Line Options | The line at the bottom of the screen contains commands to print the report and to save or change the report settings.

|

You can also set up this report on the Set Up Closing Processes screen (1-6-3) to print automatically during closing. If you set up the detailed version to print automatically, you receive this summary as well.

| Section | Item | Description | |

|---|---|---|---|

| Date Range | Range of dates for the report information. | ||

| Ticket Summary | Taxes | Up to five taxes that are set up in your system. For each tax, the report splits your sales revenue and shows you how much can be taxed. This is based on the Tax Basis setup on screen 2 of the Center Control File (1-6-1-1). | |

| Nontaxable | Nontaxable revenue. | ||

| Taxable Sales | Taxable revenue. | ||

| Ticket Summary | Gross Sales | Cost of the service before taxes, coupons, discounts or warranties. | |

| Coupon | Total amount of coupons used. | ||

| Warranty | Total amount for parts and services used to honor warranties. | ||

| Discounts | Total amount of all discounts. | ||

| Net Sales | Net sales amount.

Net = Gross – Coupon – Warr – Disc |

||

| Tax | Total of taxes for all transactions.

Tax = Tax 1 + Tax 2 + Tax 3 + Tax 4 + Tax 5 |

||

| Gift Sales | Shows the dollar amount of gift sales if a gift certificate/card was sold on the invoice. | ||

| Ticket Total | Ticket total, which equals the net amount plus tax and gift sales.

Ticket = Net + Tax + Gift Sales |

||

| Ticket Summary | Number of Tickets | Total number of invoices used in completed sales transactions only during the date range. | |

| Avg Time per Ticket | Average time per ticket. This does not include tickets over 30 minutes.

Avg Time per Ticket = (Total Time for All Tickets Under 30 min.) ÷ (Number of Tickets Under 30 min.) |

||

| Store Ticket Count | Total number of tickets being included in the store ticket average.

|

||

| Store Ticket Average | Average sales amount per ticket for store tickets. This is either gross or net sales, depending on how the Gross/Net field is set up on screen 1 of the Center Control File (1-6-1-1). A note (*) on the report indicates the setup.

Store Ticket Average = (Total Gross or Net Store Ticket Sales) ÷ Store Ticket Count |

||

| Adjusted Ticket Count | Total number of tickets included in the Adjusted Ticket Avg. | ||

| Adjusted Ticket Avg | Store ticket sales amount minus the retail price of any items that are set up with excluded categories and were sold on store tickets. Depending on the store setups, it may be the same amount as the Store Ticket Average.

Adjusted Ticket Avg = (Store Ticket Average – price of items from excluded categories) ÷ Adjusted Ticket Count |

||

| $ over Base Ticket | Dollars over base ticket average. | ||

| Average ticket > $5.00 | Average amount for tickets with net sales over $5.00. | ||

| Average ticket > $10.00 | Average amount for tickets with net sales over $10.00. | ||

| Average ticket > $15.00 | Average amount for tickets with net sales over $15.00. | ||

| Daily Avg # Tickets | The daily average number of tickets prints here if the report is for over one day. (Not shown on the sample report.)

Daily Avg # Tickets = Number of Tickets ÷ Number of Days on the Report |

||

| Ticket Summary | Bay # | Average time per ticket for each individual bay. | |

| Income Analysis | Cash Tendered | Total cash received for all sales transactions. | |

| Change | Change returned to customer. | ||

| Cash | Net cash received in all transactions.

Cash = Cash Tendered – Change |

||

| Checks | Total paid for sales in the form of a check. | ||

| Credit Cards | Total paid for sales by credit card. | ||

| Nat. Fleet Charges | National fleet charges. Total charges for national fleet customers. | ||

| Loc. Fleet Charges | Local fleet charges. Total charges for local fleet customers. | ||

| Gift Redeem | Gift certificates/cards. Total dollar amount of gift certificates/cards redeemed. | ||

| Ticket Total | Total received in payments for all sales transactions.

Ticket Total = Cash + Checks + Credit Cards + Nat. Fleet Charges + Loc. Fleet Charges + Gift Redemptions |

||

| Paid-Out | Total of paid-out transactions | ||

| Paid-In | Total of paid-in transactions | ||

| Income Analysis | CenterOpened at: | Time the start-of-day processes were run. This is blank if the report is for a date range. | |

| Closed at: | Time the end-of-day processes were run. This field is blank if the report is for a date range. | ||

| by: | ID of the employee who opened or closed the center. This is blank if the report is run for the current day before the center is closed. (This information is only included if you are set up to require the employee password for these processes. If you do not require the password, this field is blank.) | ||

| Income Analysis | Credit Card Breakdown | A breakdown of the credit card receipts showing the amount charged to each card type. Only cards used in the date range print. | |

| Income Analysis | Gift Redeem Breakdown | A breakdown of all gift card and gift certificate activity. | |

| Labor Analysis | Total Labor Hours | Total hours for all employees clocked in plus those employees set up to include hours in labor calculations (such as managers who do not clock in). | |

| Total Wages | Total wages of all employees (salary and hourly). | ||

| Total Commissions | Total commissions earned for the date range. | ||

| Net Sales | Total tickets (including quick sales) minus coupons, discounts, warranties and taxes. (This is the same as Net Sales in the Ticket Summary section of the report.)

Net = Gross – Coupon – Warr – Disc |

||

| Labor as % of Sales | Labor cost as the percentage of sales.

Labor as % of Sales = ((Total Wages+Total Commissions) / Net Sales) * 100 |

||

| Labor Cost per Ticket | Labor cost per vehicle serviced.

Labor Cost / Ticket = ((Total Wages +Total Commissions)/ Number of Tickets) |

||

| Cost of Goods | Cost of the quantity sold. This is the total cost for all items sold, determined by the cost at which you received the items and the costing method you use (LIFO, FIFO, average or standard). | ||

| Cost of Goods % | Cost of goods as a percentage of the day’s net/gross sales.

Cost of Goods / Net Sales or Gross Sales = Cost of Goods % |

||

| Labor Analysis | Tax Breakdown: | For each tax type, the total tax applied to sales. (Only those tax types used in the date range print.) | |

| Labor Analysis | * | Based on *NET* Sales or Based on *GROSS* Sales, indicating how the store ticket average is calculated. This is determined by the Gross/Net field on screen 1 of the Center Control File (1-6-1-1) | |

| Labor Analysis | Gross Profit | Total profit for the day after labor, commissions, and cost of goods. Gross Sales – Labor Cost – Total Commissions – Cost of Goods = Gross Profit |

This report is used to keep track of store performance on both a daily and a monthly basis. If you are printing the detailed report daily through the closing process, you receive this report as well. You should also print the summary report, but not the detailed report, on a monthly basis. You can use the productivity statistics on this report as a measure of store performance during a particular time period. You may find this report useful for accounting purposes as well.

Information on this report can be cross-referenced to the Franchise Report and the Revenue Reconciliation Report, as well as any of the statistics reports.