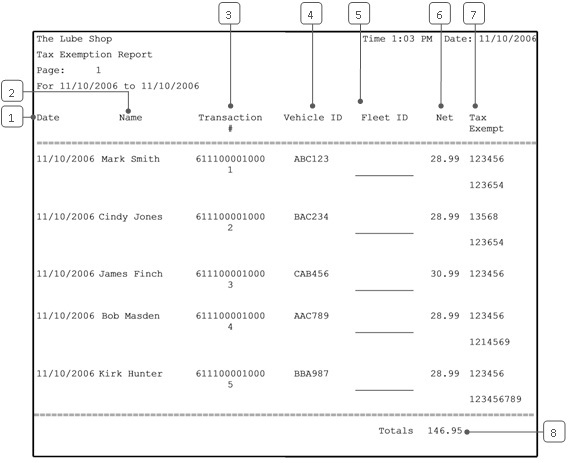

The Tax Exemption Report is a list of all invoices within a designated time frame that used a tax exempt number. It shows all the tax exempt numbers (up to five) associated with each tax exempt transaction.

Use the following steps to print a Tax Exemption Report:

| Field | Definition | ||

|---|---|---|---|

| Range of Dates | Fill in the beginning and ending dates for the range you want to include on your report. Leave blank to print the report for all information on your system. | ||

| Print Time on Report | Printing the time helps you identify the most current report when the same report is printed more than once during a day. This field defaults to Y to print the time on the report. If you do not want the time to print on a report, type N. We recommend that you always print the time on a report. | ||

| Duplex | This field appears for terminals that have report type 2 enabled in the Set Up Printer Controls screen. Duplex mode enables printing on both sides of the paper.

|

||

| Landscape | This field appears for terminals that have report type 2 enabled in the Set Up Printer Controls screen. It prints horizontally on the paper. | ||

| Number of Printed Lines per Page | This value tells the computer how many lines to print on each page of the report. A typical 11-inch page can contain up to 66 lines, but this field defaults to 60 to allow three-line margins at the top and bottom of the page.

|

||

| Total Number of Lines per Page | This field indicates the length of the paper in the printer. A typical 11-inch page contains 66 lines. Your system interprets a 0 or 66 in this field to mean that standard 11-inch paper is loaded in the printer. Because a 66 causes a form feed to take more time, accepting the default, 0, is recommended. | ||

| Print Report To | This field tells the computer where to send the report. The following list contains the different selections available for this field.

|

||

| Command Line Options | The line at the bottom of the screen contains commands to print the report and to save or change the report settings.

|

| Callout | Item | Description |

|---|---|---|

| 1 | Date | Date of the invoice. |

| 2 | Name | Name of the customer. |

| 3 | Transaction # | Transaction number. |

| 4 | Vehicle ID | License plate of the customer. |

| 5 | Fleet ID | Fleet ID at time of invoicing, if the customer was attached to a fleet. |

| 6 | Net | Total sale amount. |

| 7 | Tax Exempt | The customer’s tax exempt number. There can be up to 5 per transaction. |

| 8 | Total | Total amount of all the sales amounts. |

This report is useful for tracking the tax exempt invoices. This report can assist with exempt sales tax reporting for your state. Use this report to audit invoices to make sure sales tax exemption is correct for the vehicles listed.