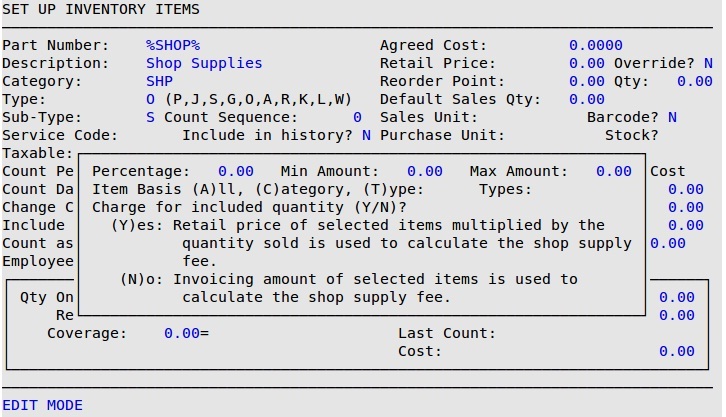

Setting up automatic shop supplies allows you to specify an amount to charge for shop supplies on invoices. A shop supply charge can be used to cover the cost of items purchased for use at the store but not directly sold to customers, such as paper towels, rags, pens, cleaning supplies, or recycling fees. It can be a specific dollar amount or a percentage of the invoice amount. You can also limit it so that shop supplies are only charged for specific categories or types of items.

Use the following steps to set up automatic shop supplies:

Percentage

Enter the percentage to charge for shop supplies. Set to 0 to deactivate.

Min Amount

Enter the minimum amount to charge for shop supplies on invoices that meet the basis requirements.

Max Amount

Enter the maximum amount to be charged for shop supplies.

Item Basis

Select which items to use to calculate shop supplies.

Codes:

Types

Select the types of items to charge for shop supplies when Item Basis is set to T. All inventory types are valid (P, J, S, G, O, A, R, K, L, W).

Charge for included quantity (Y/N)?

Select whether to use the total quantity of items, even if they are included in a job, when calculating shop supplies. Enter Y to multiply the retail price of selected items by the quantity sold to calculate the shop supply fee. Enter N to use the invoicing amount of selected items to calculate the shop supply fee.

For example, say you set up a 5% shop supply fee for all OIL category items and set Charge for included quantity to Y. If a basic full service includes 5 quarts of oil and a customer’s vehicle uses 6 quarts of oil at $6.00 per quart, the shop supply fee would be calculated as: $6.00 x 6 quarts x 5% = $1.80.

(Retail Price * Quantity Sold * Shop Supply Percentage = Shop Supply Charge)

If Charge for included quantity is set to N, the shop supply fee is calculated as: $6.00 x 1 quart x 5% = $0.30.

(Retail Price * (Quantity Sold – Quantity Included) * Shop Supply Percentage = Shop Supply Charge)

| Note: | When Charge for included quantity is set to N and the quantity sold is less than the quantity included, then the quantity used in the calculation of shop supplies for that item is 0. |