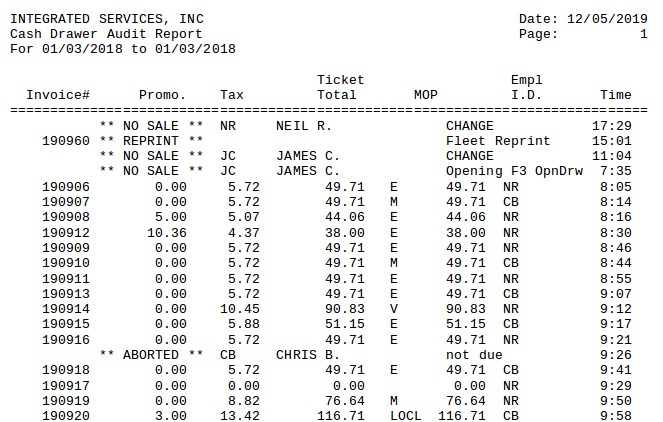

The Cash Drawer Audit Report shows all cash drawer transactions for the specified date range.

During daily operations, the processes that are related to invoicing may include the following:

The Cash Drawer Audit Report documents all of these processes. The most common event on this report is the cashing out of an invoice. For this type of event, the report includes the following information.

For transactions such as paid-in/paid-outs and aborted/voided/deleted invoices, the transaction event is shown along with employee ID and any comment entered. For money pulls, a line for each type of tender is reported along with the till number.

This report lists events according to the time the process was completed. This is not always the same as the number order of the invoices, nor is it the order in which the processes arrived at the cashier screen. The invoice numbers and times shown on the report may not be sequential for this reason.

Use the following steps to set up and request a Cash Drawer Audit Report:

| Field | Definition | ||

|---|---|---|---|

| Date | Fill in the beginning (low) and ending (high) dates for the range you want to include on your report. Leave blank to print information for the current day. This report should not be run for more than one day, because it does not include the date for each transaction, so you cannot easily distinguish between dates. | ||

| Print Time on Report | Printing the time helps you identify the most current report when the same report is printed more than once during a day. This field defaults to Y to print the time on the report. If you do not want the time to print on a report, type N. We recommend that you always print the time on a report. | ||

| Duplex | This field appears for terminals that have report type 2 enabled in the Set Up Printer Controls screen. Duplex mode enables printing on both sides of the paper.

|

||

| Number of Printed Lines per Page | This value tells the computer how many lines to print on each page of the report. A typical 11-inch page can contain up to 66 lines, but this field defaults to 60 to allow three-line margins at the top and bottom of the page.

|

||

| Total Number of Lines per Page | This field indicates the length of the paper in the printer. A typical 11-inch page contains 66 lines. Your system interprets a 0 or 66 in this field to mean that standard 11-inch paper is loaded in the printer. Because a 66 causes a form feed to take more time, accepting the default, 0, is recommended. | ||

| Print Report To | This field tells the computer where to send the report. The following list contains the different selections available for this field.

|

||

| Command Line Options | The line at the bottom of the screen contains commands to print the report and to save or change the report settings.

|

You can also set up this report on the Set Up Closing Processes screen (1-6-3) to print during closing processes.

| Item | Description |

|---|---|

| Date Range | Range of dates for the report information. |

| Invoice # | Invoice number (should match the pre-printed invoice number). Blank for non-invoice transactions. |

| Promo. | Promotions. Sum of discounts and coupons applied to invoice.

Promotions = Coupons + Discounts |

| Tax | Amount of tax charged on the invoice. |

| Invoice Total | Total amount paid by the customer.

Invoice Total = Gross Ticket Amount – Promotions – Warranties + Tax + Gift Sales |

| MOP | Method of payment. Indicates cash, check (CHK) or charge (for example, LOC indicates a local fleet). Next to this is the amount tendered. Multiple methods of payment result in more than one MOP line for an invoice. |

| Empl I.D. | Employee identifier. Identifies who processed the transaction. (This information is only included if you are set up to require the employee password for these processes. If you do not require the password, this field is blank.) |

| Time | Time the process arrived at the cashier screen. These times may not be sequential, because processes may be cashed out in a different order from the order in which they arrived at the cashier screen. |

This report can be used any time you want to know specifics of the cash drawer activity for a given day. It is the best report to use when tracking cash drawer processes such as aborted/voided/deleted invoices and no sales. This report also can be used to reconcile cash overages or shortages when balancing the till. To monitor cash drawer activity on a daily basis, you should set up this report to run during the closing processes. This report should always be run for a single day.

On this report, non-invoice processes can be a warning sign of training or employee issues. For example, multiple aborted invoices might show that employees are not aware of how to change vehicle information once it has been entered. Multiple deleted/voided invoices or no-sales may indicate shrinkage.

Other reports with information on invoice transactions are the Revenue Reconciliation Report (1-3-3-3) and the Transaction Report (1-3-2). You can use the Cash Drawer Audit Report to reconcile cash overages or shortages, or go to the Revenue Reconciliation Report for more specific information on individual sales transactions, including a list of checks and credit card amounts. The Transaction Report can be used to look at information for more than one day.