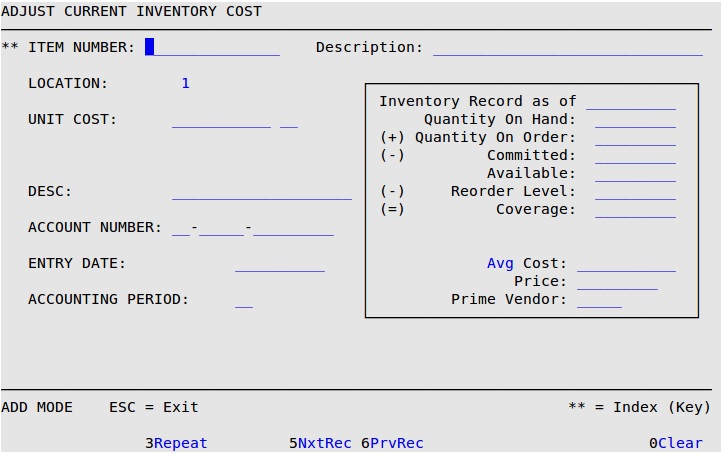

This option is used to adjust the average, LIFO, FIFO or standard cost of an inventory item that is not correct. This option only changes the current cost, not the agreed cost. To change the agreed cost, use the Set Up Inventory Items (1-7-1-2) screen.

Use the following steps to adjust your current inventory cost:

|

If you change a cost, the change affects all prior averaging that has been done for that item. All inventory in stock for that item will be valued at the new cost, and any additional adjustments to previous receipts will calculate incorrectly. |

Item Number

Type the 1- to 15-character item number for which you want to adjust the cost. You can only adjust items that are parts, oil or supplies (types P, L, or S).

| Note: | This field is marked by two asterisks (**), which indicate that the scroll order on this screen is determined by this field when the cursor is in it. For more information on scrolling, see the article Information Entry Screens. |

Description

Brief description of the item number. (Display only)

Location

The number of the location for which you are adjusting inventory items. (Display only)

Unit Cost

Type the cost per sales unit that you want to assign to this item. This cannot be zero (0) or negative.

Desc

Type a brief explanation as to why you are adjusting this cost.

Account Number

Type the account number of the item in the format of the Accounting prefix followed by the account number.

Entry Date

Date (MM/DD/YYYY) the inventory changes are entered into the system.

Accounting Period

Type the 2-digit accounting period. Usually this is the number of the current month.

| Note: | You must use the Update Inventory (1-7-4-4 or 1-7-1-4) option for the changes to take effect on reports. The Inventory File is automatically updated during the End of Day process. |