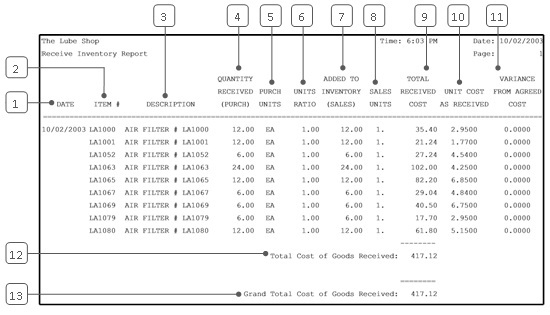

The Receive Inventory Report shows inventory added through the Receive Inventory function (1-7-1-1). It includes the following for each inventory item:

The received quantity and cost should agree with the purchase invoice. The variance from received cost is usually zero. If this number is not zero, this means the cost of the items on the purchase invoice was different from the agreed cost set up in your system.

This report prints automatically each time you receive inventory through the Receive Inventory function (1-7-1-1).

| Callout | Item | Description |

|---|---|---|

| 1 | Date | Date of receipt. |

| 2 | Item # | Identification number of the inventory item received into inventory. |

| 3 | Description | Item description. |

| 4 | Quantity Received (Purch) | Quantity Received (Purchase). Number of purchase units you received of the item. |

| 5 | Purch Units | Purchase units. Unit of measure in which the item is received from the vendor. (For example, CS indicates the item is received by the case.) |

| 6 | Units Ratio | Number of sales units in one purchase unit. (A sales unit is the unit of measure in which the item is sold and inventoried.) |

| 7 | Added to Inventory (Sales) | Number of sales units received.

Added to Inventory (Sales) = Quantity Received (Purch) * Units Ratio |

| 8 | Sales Units | Unit of measure in which the item is sold and inventoried. (For example, QT indicates the item is sold by the quart.) |

| 9 | Total Received Cost | Total cost of the quantity received according to the purchase invoice |

| 10 | Unit Cost as Received | Cost paid per sales unit.

Unit Cost as Received = Total Received Cost ÷ Added to Inventory (Sales) |

| 11 | Variance from Agreed Cost | The difference between the actual unit cost of the item and the agreed cost set up in the system.

Variance from Agreed Cost = Actual Cost – Agreed Cost |

| 12 | Total Cost of Goods Received | Total cost of all the goods received for the above date. |

| 13 | Grand Total Cost of Goods Received | Grand total cost of all goods received for all dates on the report. |

When this report prints after receiving, you can use it to make sure that inventory items have been received correctly. Compare the report with the purchase invoices to make sure that all items were entered accurately. Make any corrections through the Adjust Inventory Receipts function (1-7-1-5). You should also make sure that the actual cost equals the agreed cost. This verifies that your vendor has charged the agreed cost and shows that the system knows the true value of your inventory.

| Note: | Corrections made through the Adjust Inventory Receipts function do not appear on this report even if you print it after you make the corrections. To view your corrections, print an Adjustments Report (1-7-7-7). |

You can attach a copy of this report to each purchase invoice to provide a permanent record. The Inventory Items Received Report is another report that you can use for a second check of this information. Other reports with related information include the History by Item and History by Type reports.