The Franchise Report is a summary of income and expenses for a day or a range of days. It allows you to compare your store’s revenue with the cost of goods and labor. The first page of the report is a summary of income and expenses from sales, including the net operating income for the dates covered. The second page shows the changes in your assets and liabilities from the sales income and taxes you have collected.

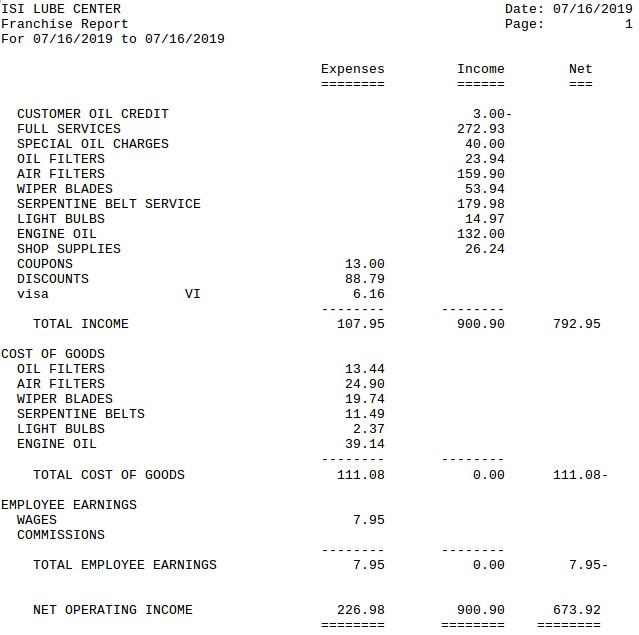

The top section of the first page reports income and expenses directly related to sales. Income is reported for all categories that had sales. (Oil credit is shown as a negative amount in the income column.) Expenses in this section include coupons, discounts, and credit card surcharges. On the Total Income line, total expenses are subtracted from total income to yield the net income from sales.

| Note: | In order to print credit card service fees on this report, you must set up percentages in the Percentage Withheld field on the Set Up Credit Card Types screen (1-6-2-1). |

Sales of inventory are not reported separately if they are part of a service package. This way, the income is only reported once. For example, if you use 500 quarts of oil in full services, no income is shown in the Oil category for those quarts. On the other hand, if you sell a single quart of oil separately to a customer, that income is reported in the Oil category.

The second section reports the cost of goods during the time period for each category of items with activity. It includes only those goods involved in sales transactions so you can directly compare cost of sales to revenue. Adjustments to inventory, transfers and receipts are not a part of these calculations. This column adds up to the total cost of goods in sales.

| Note: | The cost of goods reported here is an approximation based on the current (average) cost of goods. This value is recalculated at each inventory update. |

The third section of the report calculates employee earnings, including both wages and commission earnings. It adds these together to get the total employee earnings for the time period. The last line on the first page shows the total expenses and total income for the time period. Total expenses are subtracted from total income to give the net operating income.

| Note: | For your system to include overtime wages in the calculations on this report, you must have a Y in the Include OT on Reports field on screen 3 of the Center Control File (1-6-1-1). |

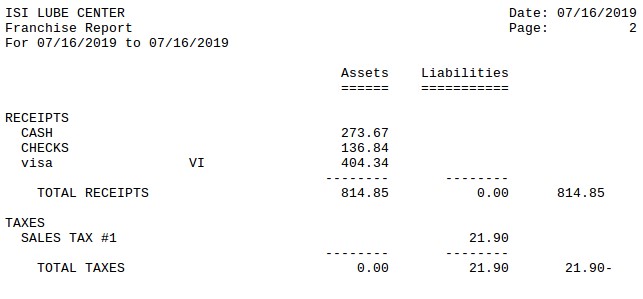

The second page breaks down the income and taxes collected, allowing you to see the amount in each type of tender or tax group. This page represents the changes in your assets and liabilities as a direct result of sales transactions.

| Note: | The income shown in the Assets column does not include the amount of gift certificates collected for services performed because they were paid for before the time of service. |

Use the following steps to set up and request a Franchise Report:

| Field | Definition | ||

|---|---|---|---|

| Range of Dates | Fill in the beginning and ending dates you want to include on your report. If you leave both the Low and the High values blank, these fields default to the first day of the current month and today’s date, based on the Center Control File date settings. | ||

| Duplex | This field appears for terminals that have report type 2 enabled in the Set Up Printer Controls screen. Duplex mode enables printing on both sides of the paper.

|

||

| Landscape | This field appears for terminals that have report type 2 enabled in the Set Up Printer Controls screen. It prints horizontally on the paper. | ||

| Number of Printed Lines per Page | This value tells the computer how many lines to print on each page of the report. A typical 11-inch page can contain up to 66 lines, but this field defaults to 60 to allow three-line margins at the top and bottom of the page.

|

||

| Total Number of Lines per Page | This field indicates the length of the paper in the printer. A typical 11-inch page contains 66 lines. Your system interprets a 0 or 66 in this field to mean that standard 11-inch paper is loaded in the printer. Because a 66 causes a form feed to take more time, accepting the default, 0, is recommended. | ||

| Print Report To | This field tells the computer where to send the report. The following list contains the different selections available for this field.

|

||

| Command Line Options | The line at the bottom of the screen contains commands to print the report and to save or change the report settings.

|

| Item | Description | ||

|---|---|---|---|

| Date Range | Range of dates for the report information. | ||

| Expenses | Cost to your store for the specified time period. | ||

| Income | Income for the specified time period. | ||

| Net | Net store income for the specified time period. This is the difference between income and expenses.

Net = Income – Expenses |

||

| Sales Items | Categories with items sold or credited on invoices. The income or expense is shown. For a category to appear on this list, you should have it set to print on the Statistics Report or the Comparative Statistics Report. Refer to Setting Up Statistics Sequences for more information. | ||

| Total Income | Total expense, total income and total net income for the time period (the sum of each of the three columns). | ||

| Cost of Goods | Cost of items from a category sold in the time period. This value is calculated using the current (average) cost determined at the time of the last inventory update.

|

||

| Total Cost of Goods | Total cost of all items sold. | ||

| Employee Earnings | Total wages and total commissions earned by employees. | ||

| Total Employee Earnings | Total employee earnings including wages and commissions.

Total Employee Earnings = Wages + Commissions |

||

| Net Operating Income | Total of Expenses, Income, and Net columns. Specifically, the Net Operating Income is the total in the Net column. This is the difference between total income and total expenses for the time period. | ||

| Assets | Increases in the store’s assets from sales. | ||

| Liabilities | Liabilities as a result of sales. | ||

| Net | Net of assets and liabilities.

Net = Assets – Liabilities |

||

| Receipts | Income received from each method of payment. | ||

| Total Receipts | Total income from all methods of payment. | ||

| Taxes | Tax collected for each tax type. | ||

| Total Taxes | Total collected for all tax types. |

Recommendations for Using This Report

This report can help you determine whether you are making enough profit from sales. In particular, you can see quickly whether your cost of goods or labor is too high relative to your income. You should print this report and evaluate it on a weekly or monthly basis. You can also use this report to help judge whether enough taxes are being set aside. This can have a large impact on your true income.

Cross-reference this report with the Inventory Usage Report, Employee Earnings Report, and Statistics Report for a more complete understanding of your income and expenses.